CORPORATE FINANCE AND STRATEGY

A formal corporate strategy is the cornerstone of an organization focused on value creation and the allocation of resources to create unique marketing advantage, set business expectations, and ultimately increase shareholder value.

When clearly defined and communicated, corporate strategy presents a shared vision that aligns the strategic goals of every business unit, department, and function. What is more, it motivates and inspires every stakeholder involved to take a long-term view of the organization so that its unifying objective may be achieved.

A Science-Based Approach

In helping set corporate strategy, it is important to perform in-depth studies and provide deep insights and recommendations for the client to pursue. We acquire knowledge through the scientific method of observing, asking questions, idea-testing, and monitoring results.

Our process begins by interviewing key stakeholders and gathering data just as in a research study. We ensure corporate leaders are kept abreast of strategy development to allow them to question and test different idea paths. Skepticism allows for the consideration of all possibilities. This approach forces leaders to examine data and test their assertions to be certain that there is evidence to support their rationale and potentially improve strategy direction.

Once the most effective corporate strategy is established, we assess the organization’s ability to absorb and implement the plan. Does the company have the internal talent required to take it forward? Does it have the operational capacity and agility to handle the integration of additional workloads? Is the culture resilient enough to withstand a transformation or survive the merging of two cultures?

Working with internal teams, we create buy-in for the corporate plan, test ideas, determine viability, and calibrate its execution. We then present to senior leadership in-depth final recommendations along with internal plans, designs, and documentation.

FUNCTIONAL BUSINESS UNIT STRATEGY

Once strategy recommendations are developed and approved, functional business unit strategies are where the rubber hits the road and carries the higher-level corporate strategy forward. While corporate plans determine the strategic direction and priorities of an organization, functional, business unit level strategies are responsible for implementing the corporate strategy in the best way possible.

The functional plan should maintain a “vertical” alignment with the corporate plan, while simultaneously holding a “horizontal” alignment with the plans of other business units. This matrix structure is required to ensure the business units are able to plan effectively and in alignment with the efforts of other business units to achieve the organization’s objectives. With plans in place, we work with business unit leaders to drive internal cultural change that will support the functional plan and determine what internal changes will be needed including skills development and team-building actions to carry out the plan.

Sustaining Value Creation

Organizations that create value carry the risk of losing that value as industries change in response to new technologies, regulations, or in answer to the unforeseen, such as a pandemic. Sustaining the value created yesterday requires continuous study, innovation, improvement, and monitoring to remain competitive today and in the future.

Once the corporate and business unit strategies are developed, we design and incorporate continuous improvement plans so the organization can repeatedly develop the processes needed to remain competitive and exceed the goals established in the corporate strategy.

While the value sustainability plan is akin to the corporate strategic plan (and can be a part of the plan itself), value creation has the flexibility to help organizations pivot in a way that continuously maximizes opportunities and returns. Combined with evergreen benchmarks and flexible decision frameworks, this level of planning is paramount for organizations in growth, scale, or preservation modes.

M&A Strategy and Preparation

As an integration planning and implementation partner, we help you prepare, execute, and continually optimize your merger or acquisition with all efforts focused on accelerating value creation. We engage in Pre-M&A Preparedness and inaugurate our partner-client relationship by establishing confidence and trust by approaching the M&A event in complete privacy.

By applying the same scientific method as in setting corporate strategy. We study your organization, benchmark it against other companies, identify industry trends, and make recommendations designed to strengthen areas of weakness prior to the merger or acquisition.

Being prepared as an organization for a M&A event is as critical as the strategy itself. Defining the strategy and plan of execution and gaining approval from senior leadership is essential throughout the process to ensure buy-in, alignment, and maximum effort. Equally important is managing organizational change and working with shareholders to understand the effects of change. These steps are just a small fraction of our strategic and operational involvement to support decision-making and inform continuous strategic scenarios such as, “if we make these changes, would we even want to sell?”

Pre- During- and Post-Merger

With a view to each dimension of your M&A strategy, we evaluate the specifics and work with organizational leaders to analyze opportunities in structure, personnel, operations, and continuous improvement. Examples of our involvement include:

Mergers and acquisitions are transformative events for organizational leaders and every stakeholder involved. We are very sensitive to issues of uncertainty, confusion, resistance, and even fear that come with change of any magnitude. Our role is to work side-by-side with you to implement and project manage your M&A strategy while keeping senior leadership abreast of all developments. Moreover, once executed and managed, we develop continuous improvement plans to maintain efficiencies and sustain value creation for your organization over time.

Strategic Planning

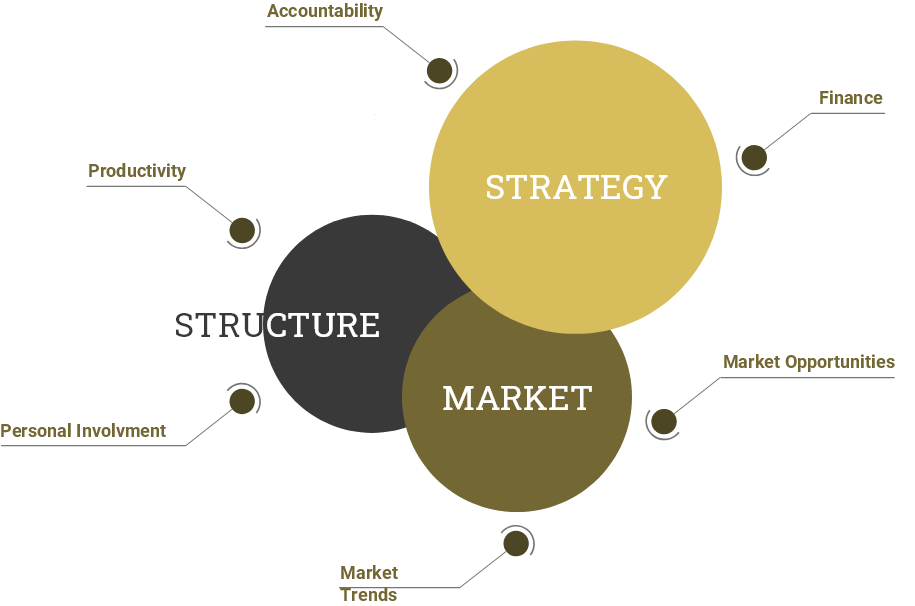

When corporate strategic planning occurs within a value-based structure, the highest levels of personal involvement, accountability, productivity, and ethical conduct become the principles shared by every person involved in achieving the organization’s objective. These are the cultural preconditions critical to effective strategic planning.

From that purpose-driven, values-based foundation, we study market conditions and conduct environmental scans to identify market opportunities, determine market trends, and track and assess changes in consumer demand. With that knowledge and insight, you are able to chart your company’s future using market opportunities as guideposts. You are also able to identify and capitalize on your internal advantages as levers to align changing market opportunities to your organizational strengths.

Our role is to create and consolidate business unit plans that are agile and can be updated at any time to accommodate changing marketing conditions without losing site of the core strategic plan and the collective values and shared vision of your stakeholders.

Family-Operated Business

We have spent decades working alongside family-operated businesses, a business structure that presents a set of special qualities and challenges unlike any other enterprise. Family emotions and internal competing factions, informal structure and culture, and uncommitted or untrained family members often top the list of challenges facing the owner or owners of a family-operated business. There is also the common conflict with hiring outside talent as a source for skills enhancement; for an objective external view of the marketplace; and potentially as a succession candidate for the sustainability, survivability, and growth of the family business.

Closely held businesses need both direct and indirect lines of communication and special structures that help manage family relationships while giving every principal the visibility they desire. This cannot be accomplished without first developing a targeted family strategy and interlacing that strategy with the family-owned business strategy. Attempting to define business strategy without first taking into account the family’s strategic goals will almost certainly under-optimize the results.

In our experience, the areas that require the greatest attentiveness with the family-owned business are first in understanding where the land mines are, as each family has a history that is important to the present and future functioning of the business. Family issues must be addressed and incorporated into the family strategy in such a way that is considerate and consistent for everyone.

Second, unambiguous and agreed upon succession plans must be defined and in place so that each family member is aware of the succession path and are in agreement with the identification of the family members who will ascend to leadership positions at specific milestones.

Taking all this into account, we create a set of advantages for the family-operated business and incorporate them into the planning process to not only generate additional value for the business, but also to bolster the sense of family purpose in a way that aligns each principal’s vision and facilitates the achievement of family goals.

Managing Risk

A key component of our Corporate Finance and Strategy engagement is to evaluate internal and external risks that could negatively impact an organization and derail its purpose and objectives. Designed into a strategic plan must be a risk management operational plan. You need to identify possible issues before they arise and address and monitor new risks that will certainly arise with changing marketing conditions and evolving business strategies.

The risk management mandate we develop with senior leadership is an element of the strategic plan that will clearly indicate the organization’s risk management strategy and objectives. The mandate will guide the execution of business unit and functional department strategies by defining a “floor of risk” higher than current market expectations while being sensitive to future market trends. Our work extends to creating flexible improvement frameworks for each business unit’s risk mitigation efforts and stress testing each plan for effectiveness.

Fine-Tuning the Finance Function

A key component in our approach to Corporate Finance and Strategy is to build functional strategy at the finance department level to maximize opportunities and returns. The strategy of finance should incorporate the corporate strategy in such a way that it creates new value for the organization by continuously aligning short term financial goals with the overarching corporate strategy.

To accomplish this, CFOs need key insights to help their finance organizations achieve financial excellence though efficiency in performance. We work with CFOs by studying the finance department and evaluating the degree to which its business model aligns with corporate strategy. This analysis includes an evaluation of the tools and internal capabilities of the finance organization; its ability to align its short-term goals with the overarching corporate strategy; and the capacity to undertake requirements for improvement.

Through our process, we identify challenges and create improvement plans that support the CFO’s business direction, which in turn generates performance-driven transformations throughout all areas of the organization touched by finance.

Let’s Discuss.

Our consultants are happy to lend ideas and approaches to support your decision making. Contact us today for a quick strategy session.

READ MORE OF OUR INSIGHTS & THOUGHT LEADERSHIP ON STRATEGIC PLANNING

Filter

Want to hear more from us?

Receive ideas, innovative business approaches, and new study information directly to your inbox.